Rejoignez-nous ce week-end pour Patrimoine Dévoilé, un événement hybride célébrant les contributions significatives des Canadiens Noirs à notre histoire, notre culture et notre société. Patrimoine Dévoilé promet un après-midi rempli d’éducation, de discussions...

Littératie Financière

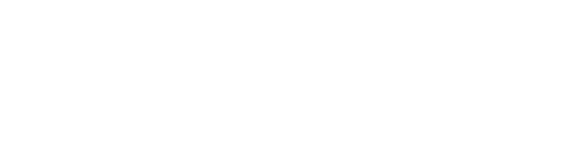

Financial literacy in the Black community is crucial for the economic prosperity of Black families across Canada. According to a 2015 report released by the Canadian Center for Policy Alternatives, 60 percent of Black Canadians fell into the bottom half of the national distribution of economic family incomes, compared to 47 per cent of non-racialized Canadians. The 2015 study also exposed further data on members of racialized communities in relation to financial literacy and economic freedom.

Did you know?

30.8%

11.9%

Racialized Canadian investors earned an average of $7,774 in investment income, compared to $11,428 for non-racialized Canadian investors.

Black Wealth Gap in Canada

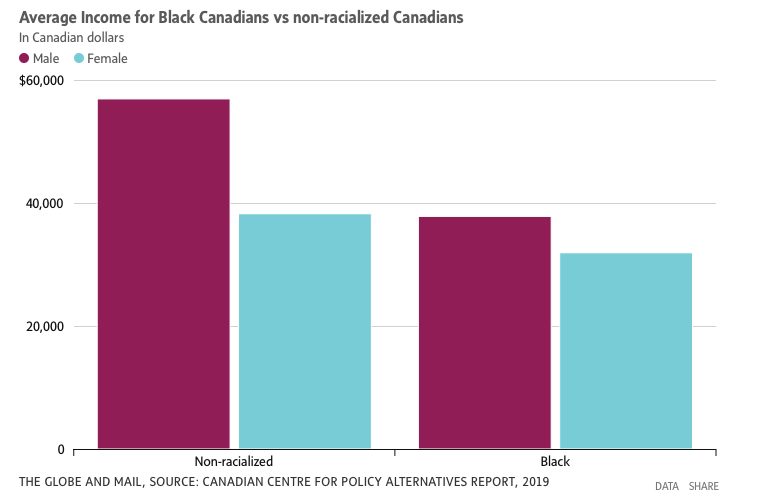

The importance of financial literacy / Intersection: Intersection of socio-economic status and Race (4th-8th)

Generational Wealth is built with Knowledge

- Education in one generation leads to knowledge in the next.

- Being financially aware strengthens economic security

- Financial literacy gives you the ability to clearly articulate your financial expectations.

Financial Literacy 101

Tax Free Savings Account (TFSA)

A tax-free savings account is an account available in Canada that provides tax benefits for saving. Investment income, including capital gains and dividends, earned in a TFSA is not taxed in most cases, even when withdrawn

Who can open a TSFA?

- Any individual that is a resident of Canada who has a valid SIN and who is 18 years of age or older is eligible to open a TFSA.

The TFSA contribution room is the total amount of all of the following:

- the TFSA dollar limit of the current year

- any unused TFSA contribution room from previous years

- any withdrawals made from the TFSA in the previous year

To learn more about your TFSA click here

Emergency Fund

An emergency fund, also known as contingency fund, is a personal budget set aside as a financial safety net for future mishaps or unexpected expenses.

|

Emergency Funds are NOT for:

|

Emergency Funds are for:

|

Watch this short clip to find out more!

Registered Retirement Savings Plan (RRSP)

A registered retirement savings plan, or retirement savings plan, is a type of financial account in Canada for holding savings and investment assets. RRSPs have various tax advantages compared to investing outside of tax-preferred accounts.

- Contributions to your RRSP reduce your income tax

- Your savings grow tax free!

- The amount you can contribute is determined by the “earned income” you report on your tax return.

- If you do not make your maximum annual RRSP contribution, any unused portion is automatically brought forward, so you can use it in any future year(s).

Child Tax Fund

The Canada child benefit (CCB) is administered by the Canada Revenue Agency (CRA). It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The CCB may include the child disability benefit and any related provincial and territorial programs.

Who can apply? Find out come here

Watch this short clip for more information on how to claim this benefit!

Resources

Tax Free Clinics Across Canada

Alberta: Salvation Army

Alberta: CPA Tax Clinic

Niagara Falls: CVITP Tax Clinic

Niagara Falls: The Alzheimer Society of Niagara

British Columbia: Kiwassa

British Columbia: NVLC

Saskatchewan

New Brunswick

Quebec

Ontario

Financial Literacy Workshops

Latest Events

Past Events

Élections Anticipées : Effets Subséquents sur les Organismes à But Non Lucratif et les Subventions (Résumé)

Autrice: Karo Daro Les élections, qu’elles soient fédérales ou provinciales, peuvent entraîner des retards ou des interruptions dans le processus de financement pour les organismes de bienfaisance, les OSBL et autres organisations qui dépendent de subventions...

Libérer le potentiel : Opportunités de subventions pour l’autonomisation communautaire

Commencez l’année en explorant une gamme d’opportunités de financement dynamiques adaptées à des initiatives communautaires spécifiques. Que vous travailliez pour améliorer la vie des aînés, participiez à des projets artistiques urbains ou défendiez la justice au sein...

Rejoignez l’équipe de Campfire Circle : Offres d’emploi pour l’été 2025

À la FCN, nous croyons au pouvoir de la communauté et à l'importance de soutenir ceux qui apportent des contributions significatives. Campfire Circle, l'un de nos Bâtisseurs Noirs Premium , incarne cet engagement en apportant joie et guérison aux enfants atteints de...