On a cold, snowy morning in February, nearly 200 people packed into the Federation of Black Canadians’ Black Leadership Breakfast to kick off Black History Month — a powerful gathering of activists, youth leaders, community groups, corporate allies, academics, and...

Financial Literacy

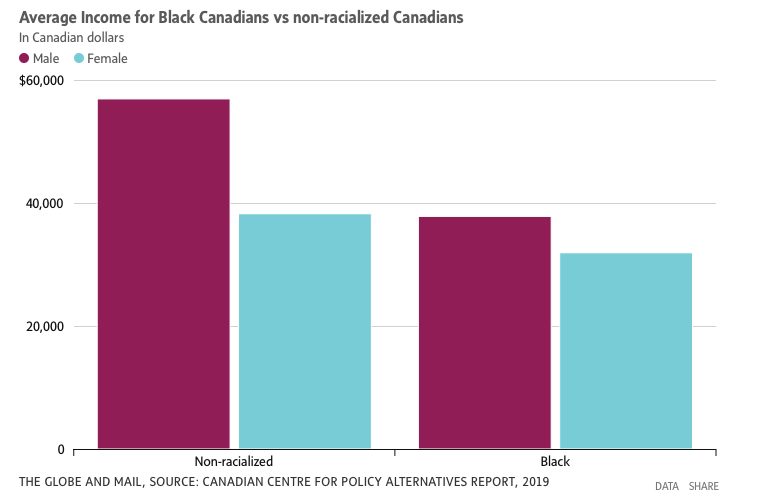

Financial literacy in the Black community is crucial for the economic prosperity of Black families across Canada. According to a 2015 report released by the Canadian Center for Policy Alternatives, 60 percent of Black Canadians fell into the bottom half of the national distribution of economic family incomes, compared to 47 per cent of non-racialized Canadians. The 2015 study also exposed further data on members of racialized communities in relation to financial literacy and economic freedom.

Did you know?

30.8%

11.9%

Racialized Canadian investors earned an average of $7,774 in investment income, compared to $11,428 for non-racialized Canadian investors.

Black Wealth Gap in Canada

The importance of financial literacy

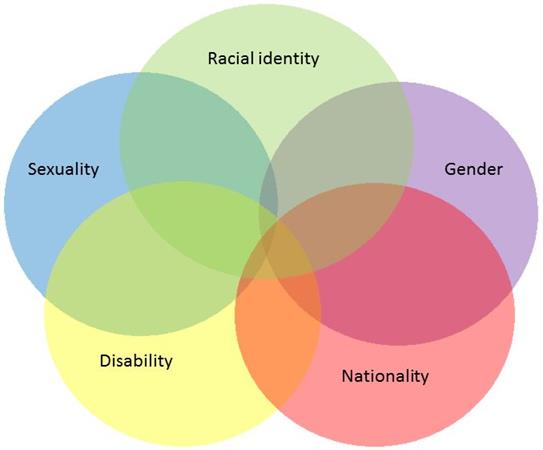

Intersection of socio-economic status and Race

Generational Wealth is built with Knowledge

- Education in one generation leads to knowledge in the next.

- Being financially aware strengthens economic security

- Financial literacy gives you the ability to clearly articulate your financial expectations.

Financial Literacy 101

Tax Free Savings Account (TFSA)

A tax-free savings account is an account available in Canada that provides tax benefits for saving. Investment income, including capital gains and dividends, earned in a TFSA is not taxed in most cases, even when withdrawn

Who can open a TSFA?

- Any individual that is a resident of Canada who has a valid SIN and who is 18 years of age or older is eligible to open a TFSA.

The TFSA contribution room is the total amount of all of the following:

- the TFSA dollar limit of the current year

- any unused TFSA contribution room from previous years

- any withdrawals made from the TFSA in the previous year

To learn more about your TFSA click here

Emergency Fund

An emergency fund, also known as contingency fund, is a personal budget set aside as a financial safety net for future mishaps or unexpected expenses.

|

Emergency Funds are NOT for:

|

Emergency Funds are for:

|

Watch this short clip to find out more!

Registered Retirement Savings Plan (RRSP)

A registered retirement savings plan, or retirement savings plan, is a type of financial account in Canada for holding savings and investment assets. RRSPs have various tax advantages compared to investing outside of tax-preferred accounts.

- Contributions to your RRSP reduce your income tax

- Your savings grow tax free!

- The amount you can contribute is determined by the “earned income” you report on your tax return.

- If you do not make your maximum annual RRSP contribution, any unused portion is automatically brought forward, so you can use it in any future year(s).

Child Tax Fund

The Canada child benefit (CCB) is administered by the Canada Revenue Agency (CRA). It is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. The CCB may include the child disability benefit and any related provincial and territorial programs.

Who can apply? Find out here

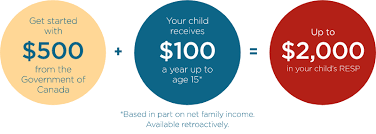

Canada Learning Bond

The Canada Learning Bond (CLB) is a $500 – $2,000 per person benefit that the Canadian Government adds to an RESP to help pay for full-time or part-time post-secondary education.

Eligibility for the Canada Learning Bond

Parents

Must be a Canadian resident

Must have a child, or children, born on or after January 1, 2004

Must have a household income of less than $49,021

More than three kids? Check here for more details

Must have a valid Social Insurance Number (SIN) for yourself and your child

Young Adults

Must be a Canadian resident

Must be turning 18 on or after January 1, 2022

Parents must have a household income of less than $49,021

Must have a valid Social Insurance Number (SIN)

Learn more about this benefit here

Resources

Tax Free Clinics Across Canada

Alberta: Salvation Army

Alberta: CPA Tax Clinic

Niagara Falls: CVITP Tax Clinic

Niagara Falls: The Alzheimer Society of Niagara

British Columbia: Kiwassa

British Columbia: NVLC

Saskatchewan

New Brunswick

Quebec

Ontario

Financial Literacy Workshops

Latest Events

Past Events

Federation of Black Canadians Recognizes Black Leadership in the GTA and Talks Youth Unemployment

On a cold, snowy morning in February, nearly 200 people packed into the Federation of Black Canadians’ Black Leadership Breakfast to kick off Black History Month — a powerful gathering of activists, youth leaders, community groups, corporate allies, academics, and...

February 2026 – Grants Black-led Nonprofits

We've got a new set of Grants Black-led/ B3 Non profits and Charities. Whether you're launching a new initiative, scaling your impact, or need support for infrastructure and capacity-building, here are current grants to help fund your Black non profit in Canada to...

Bill C-9 explained: What the Bill proposes and why it’s sparking debate.

Author: Lesly N Zeusseu TL;DR Bill C-9, officially known as the Combatting Hate Act, is a federal bill introduced in September 2025 to strengthen Canada’s response to hate-motivated crimes and intimidation. While its goal is to better protect communities targeted by...